Budget Billing

The Sensible Way to Handle Your Utility Costs

Budget Billing eases the impact of higher seasonal utility bills by spreading your bills into 11 equal monthly payments with the 12th month serving as the reconciling month. Your New Braunfels Utilities bills won’t go up and down and you’ll know exactly what your utility bill will be from month to month, making it easier to manage your budget.

How Budget Billing Works

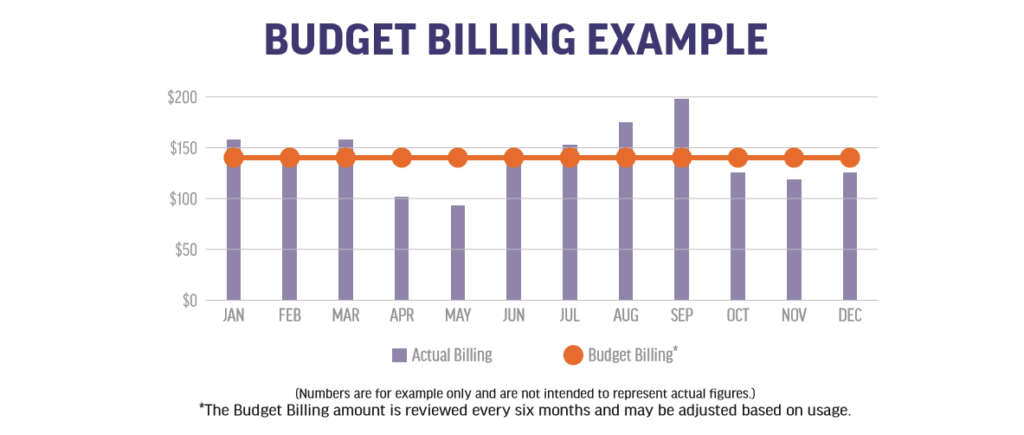

In the graph below, the blue bars indicate the sample amount that a customer would pay each billing period using NBU’s regular billing system. The total due fluctuates with usage throughout the year. The orange bar indicates the predictable amount a customer enrolled in Budget Billing would pay.

The net result is that through Budget Billing, you can avoid big changes in your utility bill — especially during peak months when air conditioning, heating, and watering can drive bills way up. Please note that the total Budget Billing costs over time will not be higher than actual costs. With Budget Billing, each month’s bill is the same. For example, in September that actual sample bill was $198.08, more than twice as much as the actual bill in May. But under Budget Billing, the September bill is only $141.20 — the same as the Budget Bill in May.

If you have been an NBU customer at the same location for more than a year, NBU totals your utility bills for the current month plus the preceding 11months and then divides the total by 11. This amount becomes your Budget Bill amount.

If a 12-month history is not available, NBU will estimate the annual billing for you.

The difference between these two amounts is called the “Accrued Budget Billing Unpaid or Credit Balance” and appears on each billing statement. This amount accumulates from month to month and shows whether a credit or debit is accumulated. New Braunfels Utilities will review the progress of the program every six months. If an adjustment is necessary before the 12 months are complete, you will be notified of the new Budget Billing amount one month in advance.

At the end of 12 months, we will look at your account to see if it needs an adjustment. The year-end balance (debit or credit) will be rolled into the next year’s cycle of Budget Billing and you will be notified of that difference one month in advance. You may elect to remove yourself from the Budget Billing program at any time. We do suggest keeping Budget Billing for at least 12 months so you may evaluate the benefits properly. Also, once you cancel Budget Billing, you must wait at least 12 months before becoming re-eligible.

Yes—each and every month you have to pay the pre-determined Budget Billing amount. Credit balances do not accrue interest. Please note, if we receive two notices of insufficient funds in your bank account, the Budget Billing program may be removed from your NBU account for one year.

Any NBU residential customer who has no outstanding bills or charges owing can sign up for the program by stopping by our office or calling, requesting a Budget Billing letter, signing the letter, and returning the original back to NBU. We will also need to enroll your account in the AutoDraft Program. With AutoDraft, your monthly payment is automatically deducted from your bank account on the actual due date. That means no stamps, no checks, no lines, and no late fees.

That depends on your typical utility usage. Generally, NBU customers have higher bills during the summer when air conditioning and water use goes up. So if your first month with Budget Billing is June, July, or August, chances are your Budget Bill will be lower.

-

Budget Billing Brochure

View PDF: Budget Billing Brochure